1. When did the Two-Pot System come into effect?

The two-pot system was implemented on 1 September 2024.

2. What is the Two-Pot System?

The Two-Pot System is a new structure for retirement savings in South Africa that divides retirement contributions into two distinct pots: the Savings Pot and the Retirement Pot. However, in reality, it results in the creation of a third pot namely, the Vested Pot.

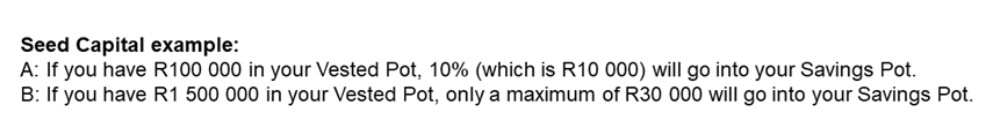

- The Vested Pot will include the value of the member's interest in the fund prior to 1 September 2024, together with fund return. No new contributions may be made into this pot, save for arrear contributions. The regime in effect before 1 September 2024 will apply, which means that members will be able to access this pot upon resignation or retrenchment. Seed capital of maximum 10% capped at R30 000 will be transferred from the Vested Pot to the Savings Pot.

- The Savings Pot will include the Seed Capital from the Vested Pot of 10% capped at R30 000, as well as 1/3 of retirement contributions made from 1 September 2024, together with fund return. This pot will be accessible once a tax year, subject to a minimum withdrawal amount of R2 000. Withdrawals will also be subject to marginal tax rates and administration costs.

- The Retirement Pot will include 2/3 of retirement contributions made from 1 September 2024. This pot will only be accessible on retirement for members to purchase an annuity

3. What is the purpose of the Two-pot System?

The Two-Pot System is an important retirement reform aimed at addressing essentially two challenges: the lack of preservation (pre-retirement leakage) due to members withdrawing their entire benefit when they resign or are retrenched; and the lack of access to retirement fund savings by members who are in financial distress but have assets in retirement funds.

4. Do my savings in the Savings Pot grow if I have not withdrawn my seed capital this year?

Yes, the Seed Capital of 10% of the Vested Pot capped at R30 000 and 1/3 of retirement contributions from 1 September 2024, together with fund return will grow and roll over to the next year if the member does not make a withdrawal.

5. How will the housing loan be calculated when a member applies for it?

The Pension Funds Amendment Act, 2024 provides that loans or guarantees granted to members in accordance with section 19(5) of the Pension Funds Act, 1956 (PFA) should not exceed 65% of the member's individual account or minimum individual reserve in the member's interest in the Savings, Retirement and Vested Pots. This means that a fund may not grant or furnish a loan or guarantee exceeding 65% of the fund value in all 3 pots combined (Savings Pot, Retirement Pot and Vested Pot) to a member. The amendment of 65% is consistent with the amended Regulation 28 to the PFA which came into effect in January 2023.

6. Will the administrators of retirement funds disclose the fees that will be charged when a member applies for a withdrawal from the Savings Pot?

Administrators are required to be transparent with the members and are obliged to communicate the fees that will be charged when members withdraw from the Savings Pot. All the necessary information must be provided to the members to enable them to make informed decisions.

7. Will the FSCA provide guidance to smaller retirement funds in terms of investments?

The FSCA does not provide investment advice. It is the responsibility of the investment managers to assist in this regard.

8. Under what circumstances may legacy retirement annuity funds be exempted from the Two-Pot System? What are the requirements for these funds to be exempted?

The process of determining conditions for exemption is at consultation stage. After the consultation process has been completed the FSCA will issue a determination setting out the conditions under which legacy retirement annuity funds may be exempted.

9. Is it necessary for section 37D deductions to be made proportionately across all three pots if there are sufficient funds in one of the pots?

The legislation dictates that the deductions should be made proportionately across all 3 pots as it will be easier for fund administrators.

10. Are members of a retirement fund able to make withdrawals from the Savings Pot if the fund is in the process of transferring assets to another fund?

Yes, they will be able to do so as the fund is still active.

11. What is the application process for members to make withdrawals from the Savings Pot?

Members will have to approach their respective HR department and the latter will facilitate the process.

12. What does the de minimis amount of R165 000 entail?

If 2/3 of a member's interest in the Vested Pot plus a member's interest in the Retirement Pot equals R165 000 or less upon retirement, the member will be able to withdraw his/her entire benefit as a lump sum. However, if the fund value is above R165 000, a member will be required to purchase an annuity.

13. Apart from the tax that will be deducted when a member makes a withdrawal from the Savings Pot, are there any other cost implications?

Each time a member makes a withdrawal from the Savings Pot, the member will be charged administration fees as per the fund rules. Further, if a member owes SARS, any such outstanding amount will be deducted first, before the withdrawal amount is paid out.

14. Is the Savings Pot attachable and executable by creditors?

Generally, a member's retirement benefit cannot be attached by creditors. The benefit enjoys protection from creditors but once the member withdraws it from the fund, the benefit loses its protection. The same applies to the Savings Pot.

15. If fund rules are not amended by 1 September 2024, does it affect the members?

Indeed, it will affect the members because the rules of the fund must be amended to give effect to the Two-Pot System as stipulated in the Revenue Laws Amendment Act, 2024.

16. Will the Savings Pot be transferred when a member joins another fund?

If a member moves from one occupational fund to another, all three pots will be transferred to the new fund.

17. Does the Two-Pot System apply to preservation funds?

The Two-Pot System generally applies to all retirement funds (pension funds, provident funds, preservation funds and retirement annuity fund). The Two-Pot System does not apply to unclaimed benefit funds, pensioners, beneficiary funds, closed/dormant funds. Legacy retirement annuity funds may be exempted if they comply with the conditions to be determined by the FSCA.

18. If a member previously made a withdrawal from a preservation fund, will he/she be able to access the Savings Pot?

Yes, a member can make a withdrawal from the Savings Pot if he/she has a minimum of R2000 in the Savings Pot.

19. How does the Two-Pot System affect members who are nearing retirement and are members of a pension or a retirement annuity fund?

These members are also entitled to make withdrawals from the Savings Pot, however they need not withdraw if they do not need the money. It is important to note that any withdrawal made will impact the fund value at retirement.

20. What happens to the member's interest in the Vested Pot after 1 September 2024?

It is worth noting that the amendments to legislation do not affect the Vested Pot. The member's interest in the Vested Pot will be regulated according to the old legislation and fund rules. In other words, the Two-Pot System does not apply to the Vested Pot and a member will still be able to access the Vested Pot upon resignation or retrenchment. Furthermore, upon retirement, the member's interest in the fund will be split into two; the one third, which a member may access in cash; and the two thirds, which a member must use to purchase an annuity.

21. What are the tax implications of making a withdrawal from the Savings Pot?

Tax will be applicable at the member's marginal tax rate.

22. In the event where a court grants a decree of divorce against the member, how will the Two-Pot System affect the non-member spouse?

The non-member spouse will still be able to withdraw his/her portion of the pension interest, which will be calculated proportionately across all the three pots.

For more information, access a downloadable brochure you can share with loved ones here.

For

more information on the two-pot retirement system visit www.fscamymoney.co.za. If you have a question, you can reach out to CED.Consumer@fsca.co.za or contact 0800 20 3722.