The Corporation for Deposit Insurance (CODI) is South Africa’s Deposit Insurance Scheme (DIS), created and mandated by law to protect qualifying bank depositors in the unlikely event of their bank failing. CODI is a subsidiary of the South African Reserve Bank (SARB) and became operational on 1 April 2024.

For a quick explainer of how CODI works, take a look at these infographics that explains what CODI is, who qualifies for CODI and which banks are CODI members. For more information on CODI, visit the South African Reserve Bank's CODI explainer or visit your bank today.

1. What is the Corporation for Deposit Insurance (CODI)?

The Corporation for Deposit Insurance is South Africa’s Deposit Insurance Scheme that ensures that qualifying depositors have reasonable access to their covered deposits should their bank fail.

2. Why do we need CODI?

It is important to have a clear plan to give depositors access to up to R100 000 of their qualifying balances in accounts in qualifying products should a bank fail. This further strengthens confidence in our banking system.

3. Which banks are members of CODI?

By law, all banks registered in South Africa are members of CODI. This includes all commercial banks, local branches of foreign banks, mutual banks and co-operative banks.

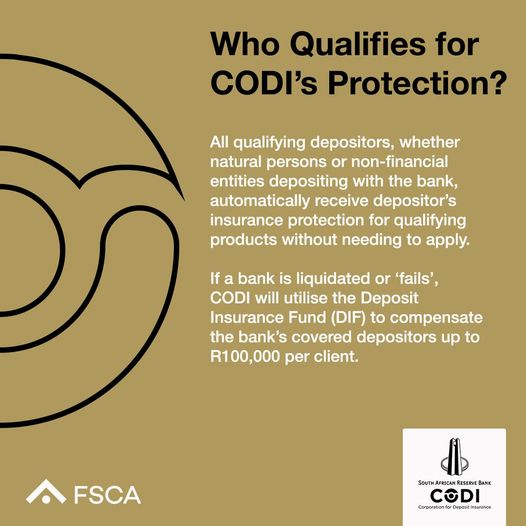

4. Who qualifies for CODI?

CODI protects retail and non-financial private depositors, whether natural persons or non-financial entities depositing witht he bank, automatically recieve the depositor's insurance protection for qualifying products without the need to apply.